Fund’s objective is to create value for investors by investing in renewable energy and related infrastructure within the European Union. By investing in “INVL Renewable Energy Fund I”, you are contributing to the transformation of the energy sector – the transition from fossil fuels as the primary source of electricity generation to renewable sources – solar, wind, etc. The fund allows you, as an investor, to achieve individual ESG goals or implement individual sustainability initiatives with the ability to measure their impact – reducing CO2 emissions, creating jobs, and stimulating economic growth.

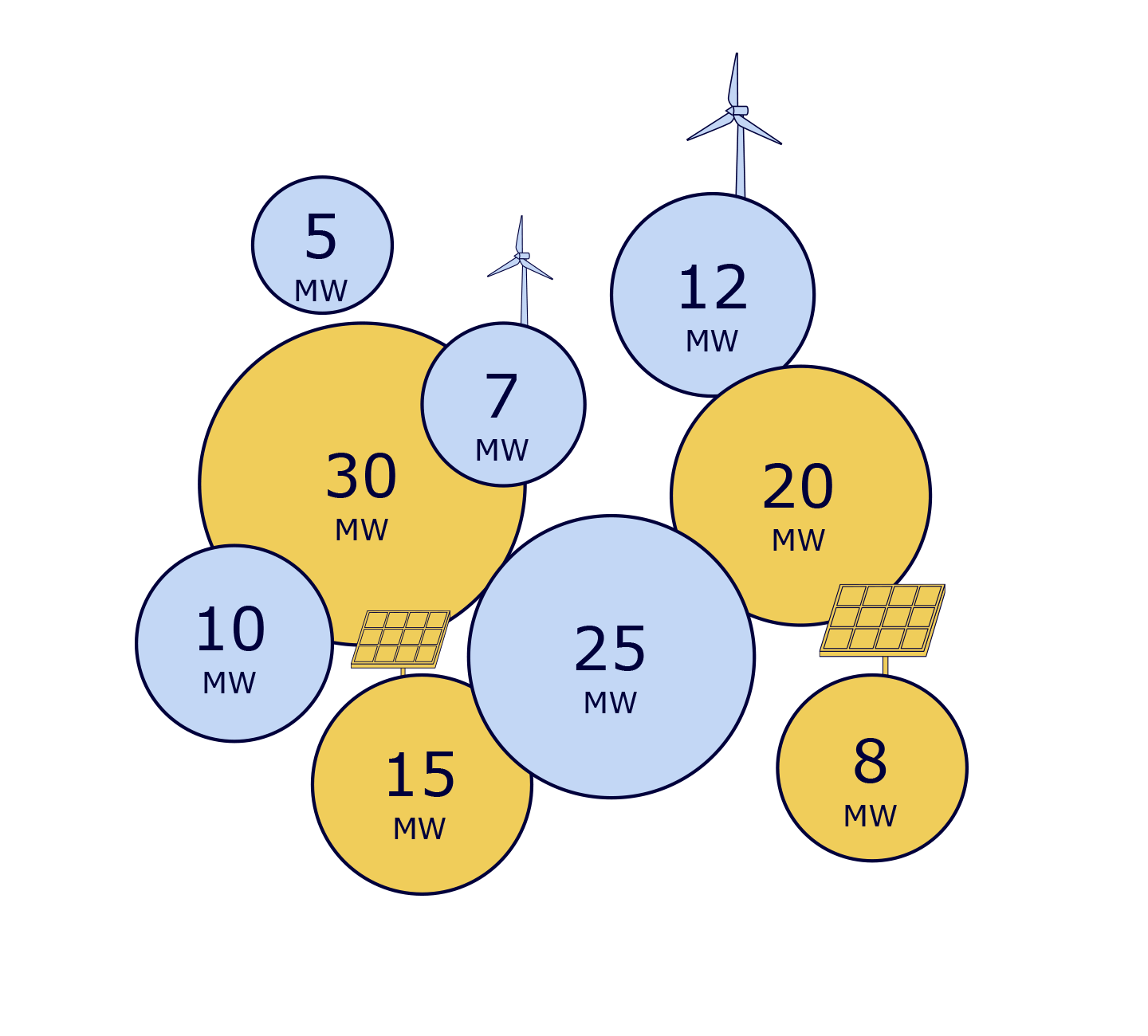

Standardized portfolio criteria:

long-term electricity sales contacts, PPA;

inflation-protected feed-in tariffs, CfD;

standardized production technology.

Attractive size for large institutional investors.

Long-term, easily predictable cash flow.

Economies of scale due to management cost optimization.

Potential premium due to portfolio size.

Everyone can contribute to environmentally-friendly action. Trivia such as responsible consumption, energy-saving, and responsible waste sorting turned into habits will ensure that environmental traditions are passed on to future generations. An even more effective step towards a sustainable and clean future – is investing in renewable energy.

By investing in renewable energy with our available capital, we contribute to increasing the well-being of society and “greening” the environment while at the same time generating a competitive return for investors.

In 2019 December, the Council of European Union announced a “Green Deal” intending to become the world’s first environmentally neutral continent based on a circular economy. Given the objectives pursued and the scale of the investment required, the EU is prioritizing green investments in the Union’s budget and is seeking to mobilize at least 1 trillion EUR for this purpose. The fund’s strategy is consistent with these developments.

Currently, the most common investments are in solar and wind farms. In the near future, however, we will see investment in energy storage and hybrid farms that combine both wind and solar generators.

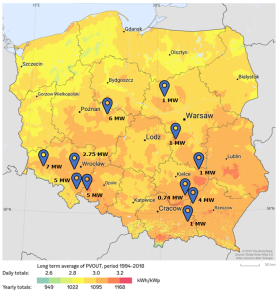

In the context of the development of renewable energy projects (wide specialization of companies developing projects, electricity supply, project financing possibilities, etc.), Poland is the most developed market in the Central and Eastern European region.

The first acquisitions of the fund in Poland were made in September 2021. Since then, the fund has accumulated a portfolio of 34 MW of solar PV projects with approved grid connection conditions.

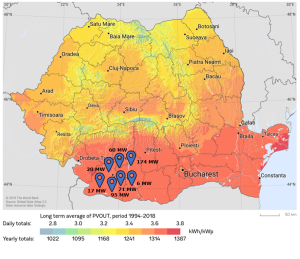

At the end of 2021, the Romanian government confirmed a legal framework for bilateral (without the intermediary of electricity suppliers) long-term electricity purchase and sale contracts. Romania has 30% more sunny hours suitable for electricity generation compared to Poland.

The first acquisitions of the fund were completed in March 2022. Since then, the fund has accumulated a portfolio of 269 MW of solar PV projects with approved grid connection conditions. Additionally, the approval of the conditions for connecting the 174 MW project to the grid is expected in April 2023.

Attractive 11+ percent projected net return (net IRR), which can help hedge against low-interest rates, rising inflation, and other adverse economic scenarios.

In order to reduce investment risk, investments are made in the European Union (EU) markets, where the development of renewable electricity is promoted by ensuring a stable and predictable environment for investors and where the practice of long-term electricity purchase contracts is popular and projects can be developed through risk diversification.

In order to attract more green investment to their countries, EU countries are organizing or planning to organize auctions of planned electricity quotas, providing independent investors with a return on investment protection for a period of 15-20 years.

Please note that the investment return projections of a collective investment undertaking are based solely on the views of those directly and / or indirectly involved in the management of that collective investment undertaking and do not in any way guarantee future results. All investment-related risk of loss is borne by investors.

In Lithuania, the fund’s units are distributed by the financial brokerage company “INVL Finasta”, the minimum investment amount is 125 thousand EUR. The duration of the fund is 7 years. “Invalda INVL” group, together with the sub-fund’s partners, will invest 1.3 million EUR in this sub-fund.

Contact by email [email protected] or tel. +370 527 90601.

This page contains only generalized information that is not tailored to the individual needs of any person. It is not, and should not be construed as, promotional information or information that offers, recommends or otherwise encourages you to become a participant and assume the risks associated with a collective investment undertaking referred to on this page.

The information provided on this website about the characteristics of the collective investment undertaking or the projects in which it invests (including investment return projections) is based solely on the views of those directly and / or indirectly involved in the management of that collective investment undertaking. In giving this opinion, individuals act solely in their own interests and do not follow or take into account the individual interests and needs of any other person. Therefore, any person makes any investment decision at his or her own risk and must, at his or her own discretion and expense, use experts in the relevant fields to make a decision that meets his or her individual needs. Only in this way can the decision-maker reduce the losses that are particularly likely to occur (due to an investment in the collective investment undertaking mentioned on the page).

Please note that the past performance of a collective investment undertaking reflects only its past performance. Past performance is no guarantee of future results. If the return on investment has been positive in the past, it will not necessarily be so in the future, and the value of the investment may rise or fall. Persons directly and / or indirectly involved in the management of the collective investment undertaking mentioned on the page do not guarantee the profitability of the investment. All investment-related risk of loss is borne by investors.

Before becoming a member of the collective investment undertaking mentioned on this page, you must assess yourself or with the assistance of relevant experts all applicable fees, all risks associated with the investment and carefully read all documents.

Notwithstanding other important information provisions, it is recommended that you invest only those funds that you can afford to lose.